32 Ways to Save Tax

Want peace of mind knowing you and your business are as tax efficient as possible…

Some of the most popular questions we get asked by clients are, “How can I pay myself tax efficiently?”, “What expenses can I put through my business?” “How can I reduce my tax bill?!

If you want the answers to these questions, book in for a 32 Ways to Save Tax Review.

Our clients are delighted with the results and you will be too. So much so, that if we can’t uncover tax saving opportunities worth at least 3 times the fee, then we won’t charge a penny. That is a guarantee.

In our ‘Extracting Value’ tax diagnostic review we will identify all the: tax advice needs, tax saving opportunities, allowances, incentives and reliefs, applicable to your business.

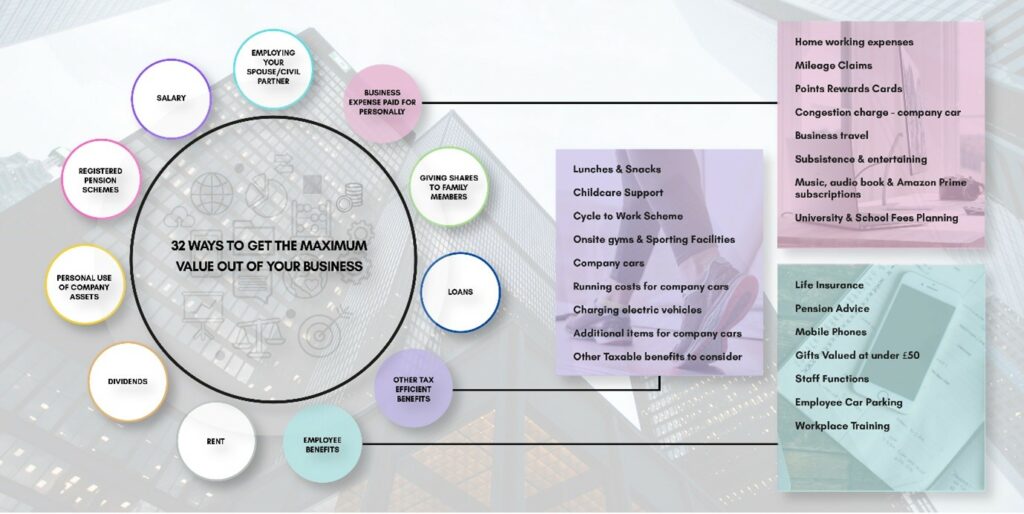

The review covers up to 32 tax efficient ways to take the maximum value out of your business. These are things that relate to you, your family, your life, your business.

Let’s make sure you’re doing them as tax efficiently as possible!

WHAT’S INCLUDED

As part of the tax diagnostic review we will:

• Complete a full analysis of the 32 ways to identify all the tax advice needs, tax saving opportunities, allowances, incentives and reliefs, applicable to your business.

• Produce a detailed report outlining all the tax advice needs, tax saving opportunities, allowances, incentives and reliefs, applicable specifically to your business.

• Produce an action plan outlining the priority areas for you and your business to focus on, including estimated tax savings and quotes for the delivery of recommended tax advice.

FEES

The ‘Extracting Value’ tax diagnostic review is suitable for small stable businesses that are keen to explore the different ways to tax efficiently put things through the business, or take value out of the business to benefit yourself as a business owner.

Extracting Value Tax Diagnostic = £250 -£1,325+vat

Tax Advice

At the end of your tax diagnostic review, tax advice will be identified to improve your tax position, to make a future saving, or to get cash back into your business.

Where tax advice is identified, we will provide calculated tax savings, a proposal of work and a quote for the delivery.

All tax advice will be quoted for separate from the tax diagnostic review fee.

BOOK A TAX DIAGNOSTIC REVIEW & GET MORE FOR YOU!

The likelihood is you’re not currently maximising all the tax saving opportunities available to you – and you could be missing out. Book your tax diagnostic review, get full control and peace of mind you’re getting the most value you can.

Contact Us

Find out what we can do for you